I Wanna Build MORE in Super but They Won’t Let Me!

(Reducing the Super Concessional Contributions Caps)

The government has halved the total you can tax effectively put into super from salary sacrifice and your employer contributions (known as concessional contributions because they are concessionally taxed at a maximum of 15% instead of your marginal rate). If you are self employed, the total amount of contributions you can claim as a tax deduction has also been halved.

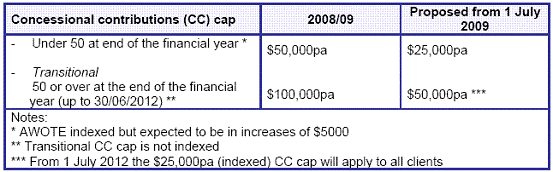

The changes apply from 1 July 2009. The table below compares the concessional contributions cap applying up to 30 June 2009 with those proposed to apply from 1 July 2009.

During periods of change, it’s likely that you will need to re-examine your individual circumstances. When undertaking this re-examination it’s important to note that the key parts of the superannuation vehicle that drive its tax efficiency have remained unchanged. That is:

- Pre-tax employer and personal deductible concessional contributions remain taxable at a maximum 15% rate as they enter the superannuation fund.

- A maximum 15% tax rate on earnings continues to apply in the accumulation phase, with a nil tax rate on earnings in the pension phase; and

- Tax-free lump sum and pension retirement benefits will continue when accessing funds after reaching age 60.

The proposed halving of the concessional contribution (CC) cap from 1 July 2009 is significant if you were intending in future years to contribute amounts up to the existing $50,000 pa ($100,000 pa for 50 year olds during the transitional years ending 30 June 2012).

Note that Superannuation Guarantee (9% SG) contributions are included in the cap (i.e. they are not in addition to the cap). Likewise, concessional contributions made to pay for the cost of insurance inside superannuation is also included in the CC cap.

The current cap on non-concessional contributions (after tax member contributions) is $150,000 per annum (2008/09 financial year) and will remain at that level in 2009/10. In the future, the cap will be calculated as six times the level of the (indexed) concessional contributions cap.

From a longer term perspective the reduction in the cap will serve to reinforce the need for clients to look to maximise contributions as early as possible. This is because the new cap rules do not allow for “catch up” contributions later in life as retirement approaches.

So, what’s the Strategy?

You have until 30 June 2009 to use the $50,000 cap for employer contributions (including salary sacrifice) and personal tax deductible contributions (or $100,000 for over 50's)

The concessional contribution cap for 2009-10 will be reduced to only $25,000 for the under 50s. You must review your salary sacrifice and other contribution arrangements to make sure you do not breach this cap in the new financial year. If you do breach the cap, you will pay 46.5% tax on the amount of contribution over the cap. Ouch!

The transitional $100,000 for over 50s has reduced to $50,000 from 1 July 2009 to 30 June 2012. Then it phases out completely, back down to $25,000…so again, you must review your salary sacrifice/contribution strategy as soon as possible.

Special Alert for Government Employees, Military Personnel & members of Defined Benefit Schemes

You will need to check with your scheme to see how much of the defined benefit counts towards the contribution caps to ensure that you do not breach the caps when using salary sacrifice.

CSS/PSS Members

|

Salary for Super Purposes (Gross before tax) |

Amount counted towards the Concessional Contributions Cap (PA) | |||

|

From / FN |

To / FN |

From PA |

To PA |

|

|

- |

1,670.67 |

- |

43,437.42 |

1,303.12 |

|

1,670.68 |

2,690.67 |

43,437.68 |

69,957.42 |

3% of salary for super purposes |

|

2,690.68 |

4,036.00 |

69,957.68 |

104,936.00 |

2,098.72 |

|

4,036.01 |

+ |

104,936.26 |

+ |

2% of salary for super purposes |

Military Super & DFRDB – 3% of salary for super purposes counts towards the cap

Contact us asap and we will send you the special Bentham Financial CC Cap Calculator for Public Servants and Military Personnel.

Any advice given is of a general nature only and has not taken into account your objectives, financial situation or needs. Because of this, before acting on any advice, you should consult a financial planner to consider how appropriate the advice is to your objectives, financial situations and needs.